Fallouts from the Russia-Ukraine war and global commodity-price spiral may stymie Bangladesh's economic growth and also fuel inflation by this fiscal yearend, the central bank forewarns.

The Bangladesh Bank (BB) in its latest quarterly economic review report, released Monday, forecasts that the growth momentum is expected to be stronger in the rest of the current fiscal year (FY) 2021-22, hinging upon growth-supportive fiscal and monetary measures, growing external and internal demand, improving Covid-19 situation, and rising business confidence.

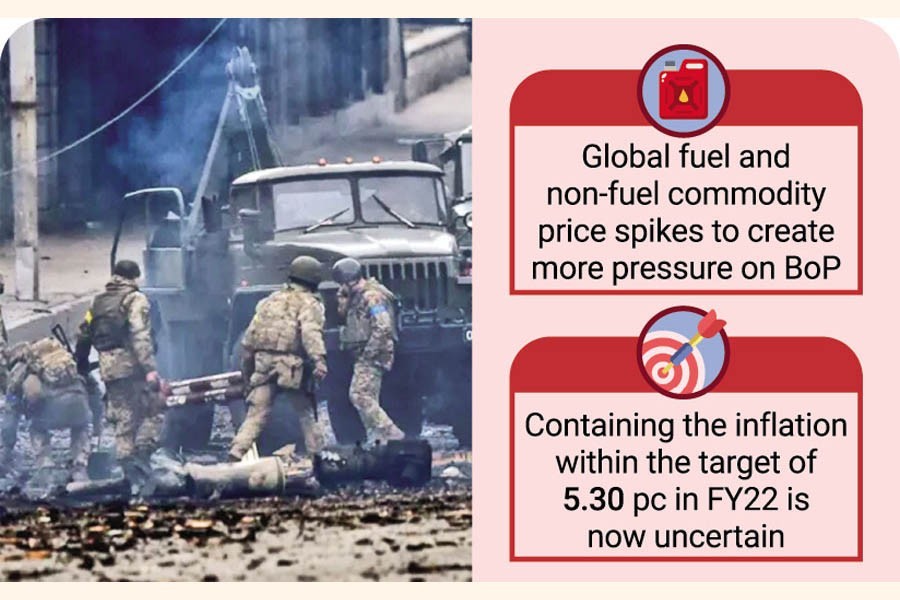

"However, headwinds to this growth outlook could emerge from many factors, such as the unfavorable outcomes of the Russia-Ukraine war and elevated global commodity prices," the central bank said in its Bangladesh Bank Quarterly (BBQ) for October-December 2021.

Besides, the sharpening of global energy and non-energy commodity- price spikes caused by the Russia-Ukraine war may translate into domestic prices and create an unfavorable position in the balance of payments in the coming months, it added.

"…. a rising domestic demand due to economic rebounds along with increasing global energy and commodity prices amid the Ukraine-Russia war may put some upward pressure on inflation in the coming months," the central bank noted.

Its recently published Monetary Policy Review also forecast the inflation to be stayed in the range of 5.9-6.3 per cent in June 2022, indicating an uncertainty to contain the inflation within the target for FY'22.

In that situation, the central bank recommends adopting a coordinated fiscal-monetary policy action to anchor inflation expectation and continue the growth momentum in the near and medium terms.

Experts as well as economists urge the government to take effective policy measures immediately to face possible external pressures on the economy following the ongoing Russia-Ukraine war.

"Uncertainty in the external economic outlook of Bangladesh is intensifying gradually because of the Russia-Ukraine war," Mustafa K. Mujeri, executive director of the Institute for Inclusive Finance and Development (InM), told the FE.

Dr Mujeri, a former chief economist at the BB, noted that the inflationary pressure on the economy had already increased following higher prices of commodities on the global market.

Meanwhile, by official count, the inflation as measured by consumer price index (CPI) rose to 6.17 per cent in February 2022 from 5.86 per cent a month before on point-to-point basis while the inflation reached 5.69 per cent from 5.62 per cent on 12-month average.

The inflation is likely to increase further in the months ahead because of the Holy Ramadan and the Eid-ul-Fitr festival, the senior economist predicts.

Dr Mujeri also said the ongoing upturn in the current-account deficit may continue in the coming months if the lower inflow of remittances and higher import expenses persist.

Meanwhile, the country's current-account deficit exceeded $10-billion mark during the July-January period of FY, 2021-22, following higher import-payment obligations alongside lower inflow of remittances.

The current-account deficit rose to $10.06 billion during the period under review from $8.18 billion a month ago. It was $1.56 billion surplus in same period of FY'21.

Inward remittances dropped nearly 18 per cent to $15.30 billion during the July-March period of FY'22 from $18.60 billion in the same period of FY'21, BB data show.

"It's a largest current-account deficit in the history of Bangladesh," the economist explained.

Actually, the soaring deficits in trade as well as the current account reflect the growing imbalance on the external front, thus creating mounting pressure on the country's overall balance of payments (BoP).

The BB data show that the BoP posted a negative balance of $2.05 billion in the first seven months of FY'22 against a positive balance of $6.41 billion in the same period of FY'21.

Talking to the FE, Shah Md. Ahsan Habib, professor at the Bangladesh Institute of Bank Management (BIBM), said Bangladesh may face higher inflationary pressure in the coming months mainly due to higher prices of commodities along with fuel oils on the global market.

"It may also create pressure on BoP in the near future," he explained.

The government has already projected GDP (gross domestic product) growth at 7.2 per cent for FY'22 while inflation was targeted at 5.30 per cent on an average 12-month basis.

Given Bangladesh's relatively smaller trade linkage with Russia and Ukraine, the direct adverse impact of the war on Bangladesh is expected to be modest, according to the BBQ.

"However, if the war lingers and propagates in neighboring other European countries, which are major destinations of Bangladesh's export and source of remittance inflow, the damaging effects of the war on Bangladesh might be non-trivial," it notes.

The central bank also said there may not be any major impact on remittance inflows assuming migrant in the war-affected part of Europe will not face any difficulty in remitting money.