The central bank has announced to continue with its ongoing expansionary monetary policy amid a cautious stance for the current fiscal year (FY) to help boost recovery of the pandemic-hit economy.

The Bangladesh Bank (BB) posted the monetary policy statement (MPS) for FY 2021-22 on its website on Thursday.

The MPS aims to support investment and employment-generating activities, and help create enabling conditions for the businesses so that they could normalise production and restore supply chains.

"We've formulated expansionary and accommodative monetary policy stances with maintaining a cautious approach for offsetting the adverse impact of coronavirus on the economy along with creating fresh quality employment opportunities in the country," BB governor Fazle Kabir said, explaining the MPS goals.

The central bank will also remain vigilant over any threat against the stability of the country's financial system stemming from the excess liquidity. It can conduct 'open market operations' or change the policy rates, according to the governor, if needed.

"IT-based off-site supervision has already been strengthened to ensure the proper use of the stimulus packages," the central bank chief noted.

Besides, the central bank is also considering actively conducting a special on-site examination to know about the use as well as results of the government-announced stimulus packages, he added.

The BB would continue with its support for productive and employment-sensitive priority sectors while strengthening its monitoring to ensure the quality and purpose of the loans.

The MPS projected a GDP (gross domestic product) growth of 7.2 per cent for the FY and expected the annualised inflation to remain within 5.3 per cent in June next year- similar to the projection made in the national budget for the current FY.

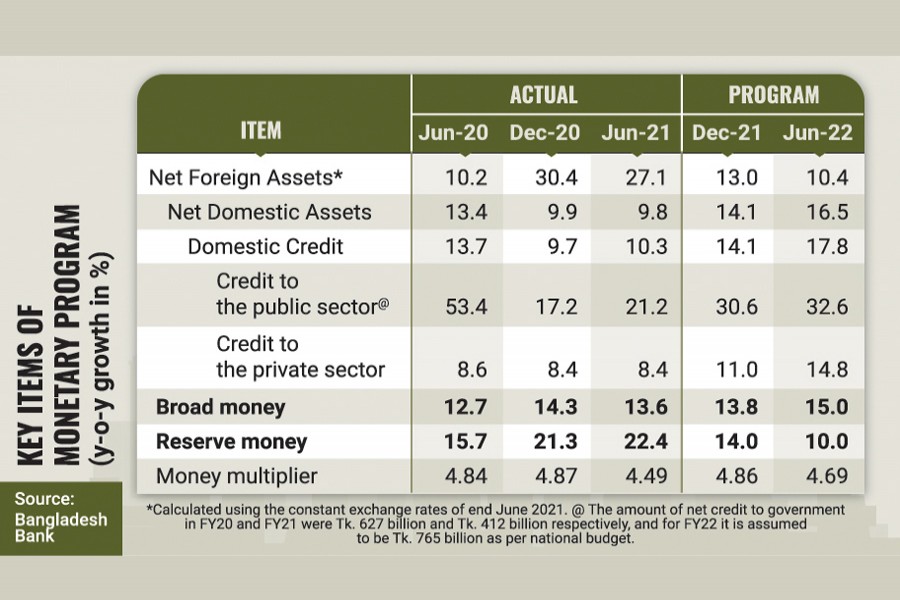

The central bank fixed the private sector credit growth ceiling at 11 per cent and 14.8 per cent respectively for the first half (H1) and second half (H2) of FY '22.

The public sector credit growth target was fixed at 30.6 per cent and 32.6 per cent respectively for the H1 and H2.

The BB's latest projection came against the backdrop of falling trend in the private sector credit growth in the recent months mainly due to the ongoing second wave of the Covid-19 pandemic in Bangladesh.

Private credit growth rose to 8.40 per cent year-on-year in June 2021 from 7.55 per cent a month ago. The growth was 8.79 per cent in March 2021.

It was 6.40 percentage points lower than the BB's target of 14.80 per cent for the second half of FY'21.

The BB senior officials were, however, hopeful about achieving the private sector credit growth target at 14.8 per cent by the end of this FY if the ongoing Covid-19 vaccination programme continues.

They also viewed that the possible inflationary pressure on the economy would be a downside risk of the MPS.

The projection about the private sector credit growth has been kept unchanged given the fact that the pace of credit demand will pick up in the coming months with the expectation that the economy will reopen soon as the pandemic containment measures are underway in terms of broad based national vaccination and other health-related safety programmes, the BB explained.

"We expect that the private sector credit growth may pick up by the end of this calendar year," Md. Habibur Rahman, an executive director of the central bank, told the FE while replying to a query.

Dr. Rahman also said the ongoing expansionary policies for both monetary and fiscal segments will help touch a double-digit private credit growth by June 2022.

Meanwhile, the banks' excess liquidity hit an all-time high of Tk 2.31 trillion as of June 30 this calendar year, fuelled by a lower private credit growth in a sign that the investment situation has cooled.

"The BB will remain vigilant to continuously monitor the commodity and asset price developments along with the progress in money as well as foreign exchange markets, and will take appropriate policy measures as required," the MPS noted.

It also said that substantial improvements in both domestic and external demand, especially with the advancement of vaccination against the Covid, in the coming months are expected to be favourable in tackling excess liquidity and bringing good balance between the local currency and foreign currency markets needing no additional measures.

Meanwhile, the inflation as measured by consumer price index (CPI) overshot the government's target in FY'21 because of higher food prices along with other essentials in the global market.

Average inflation rose to 5.56 per cent in FY'21 as the government set the rate at 5.40 per cent, according to the latest data of the Bangladesh Bureau of Statistics (BBS).

It was 5.48 per cent in FY19.

However, any further deterioration of the existing corona pandemic situation amid the continuation of global price hikes and any other unexpected crop loss in the next seasons due to natural calamities like floods, cyclones, etc. might create some undue price pressure down the road, according to the MPS.

Besides, the presence of a huge amount of surplus liquidity in the economy attributed to the ongoing expansionary fiscal and monetary stances may contribute to form some price pressures in the coming days.

"In this case, the central bank will remain vigilant and take appropriate courses of action to tackle the situation," it noted.

The central bank, however, fixed domestic credit growth target at 17.8 per cent for FY '22 while goals of broad money (M2) supply and reserve money have been projected at 15 per cent and 10 per cent respectively.

For encouraging new entrepreneurs with generating fresh employment opportunities, the BB will provide four types of policy supports, including continuation of ongoing refinancing schemes, fully operationalise its credit guarantee scheme to expedite the cottage, micro, small and medium enterprises (CMSMEs) financing and permitting banks and non-banking financial institutions (NBFIs) for opening technology-driven sub-branches in the rural remote areas of Bangladesh.

Besides, the central bank will bring the education sector, perhaps the most affected sector due to the COVID-19 pandemic, to the refinance scheme so that both the needy teachers and the students can get their minimum required amount of loans for purchasing necessary electronic equipment, smart devices.

"BB's monetary policy will remain supportive of the much-needed shift of the long-term financing sources, away from the banking system and towards the capital market," it noted.

The policy rates, including CRR (cash reserve requirement), SLR (statutory liquidity ratio), Repo and Reverse Repo, remained unchanged for the current fiscal year, according to the MPS.