Global crisis-driven austerity measures taken during last couple of months may save Bangladesh an estimated Tk 350 billion, thus cushioning the exchequer against the sort of severe financial crises facing many countries.

The government had resorted to the cost-cutting action amid global financial instability triggered by the Russia-Ukraine war in the world's supply hub no sooner had the world pandemic given a respite from pervasive socioeconomic disruptions.

After slapping the thrift measures like stopping fund release for less- important development projects, suspending foreign tours of government employees, procurement of cars for its employees, spending on fuels and power, and training, the ministry of finance is monitoring how the measures are working, say officials.

"We get spending reports fortnightly and check how effective the measures are," a senior official at the ministry of finance told the FE Monday.

He thinks if the austerity continues throughout the year, the national expenditure may come down by Tk 350 billion.

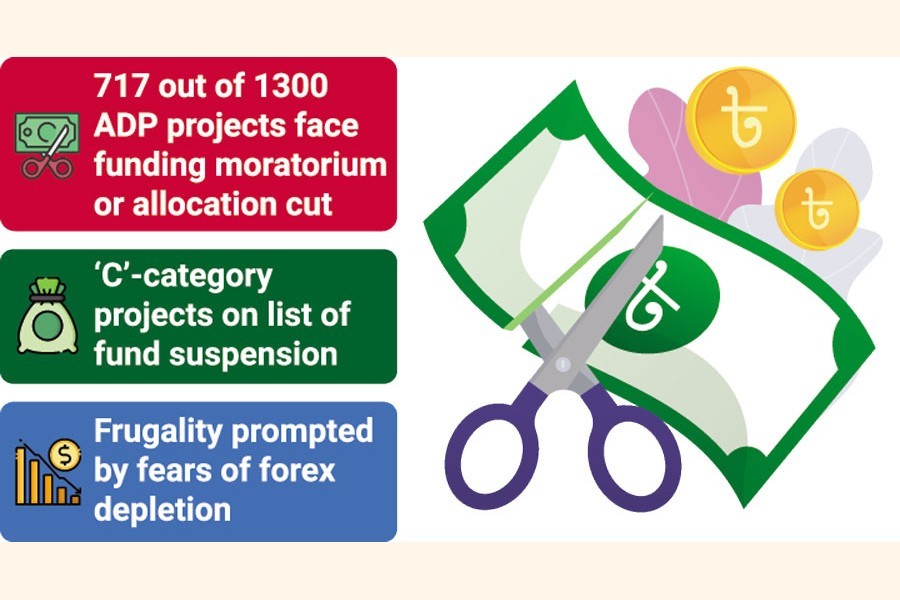

The official says a large chunk of the expenditure cuts will be from funding postponement or lesser money for development projects. In this regard, some 717 out of nearly 1300 projects in the annual development programme (ADP) of the current fiscal year 2022-23 have been listed.

The 'C'-category projects, considered less-important ones, would not get any funding this fiscal year, as instructed, thus saving a great deal of fund requirement.

Under a circular issued by the ministry of finance on July 3 implementation of the 'A'-category projects will continue on priority basis while the 'B'-category ones will get up to 75 per cent of funds keeping 25-percent government part unspent.

Fund release for 'C'-category projects will remain suspended for an indefinite period. "After issuing the orders to curb spending we have put blockade on some 'heads' in the IBASA++ system through which funds are released automatically," says another finance official.

The government offices would not be able to spend money under those particular heads, as instructions given to the system, he adds.

Lesser export earnings, higher import bills, and a looming shortfall in revenue collection in the coming days, the government has opted for the frugality as reserves of foreign currencies continued declining -- chiefly under pressure of high-cost imports.

To cushion forex spending, which came down from US$48 billion to nearly $39 billion, the government also put cap on import of various unnecessary products by raising the rate of letters of credit (LC) margins. The steps lessened the opening of import LCs in July by 31 per cent and also August is seeing a similar trend.

In the meantime, the government Monday rolled out another course of abstemiousness -- like two-day weekend for academia and rescheduling bank hours as 9.00am-4.00pm.