Finance Minister AHM Mustafa Kamal tabled the budget proposals for the financial year (FY) 2020-21 in parliament on Thursday as the Covid pandemic continued to wreak havoc on life and economy.

His budget presentation coincided with some key economic figures such as revenue earnings, export receipts and remittance inflow taking an ugly look. The projection about global economy plunging into severe recession has only intensified worries.

The ongoing situation is an unusual one and it necessitates unusual measures, but the finance minister barring certain deviations has stuck to the old way of presenting a budget that many may find highly ambitious under the prevailing circumstances.

Taxpayers, both individual and corporate, will certainly cheer the tax relief offered in the budget, but prospect of achieving the tax revenue target set in the next year's budget remains very much clouded.

The shortfall in tax revenue receipt during the outgoing fiscal has been substantial. Achieving a tax target of Tk. 3.30 trillion during the next fiscal, by all counts, seems impossible because of the uncertainty triggered by the pandemic.

However, a major improvement in tax revenue collection is possible only if the tax administration implements on an urgent basis some reforms that have been pending for long. But that would be too much to expect right at this moment.

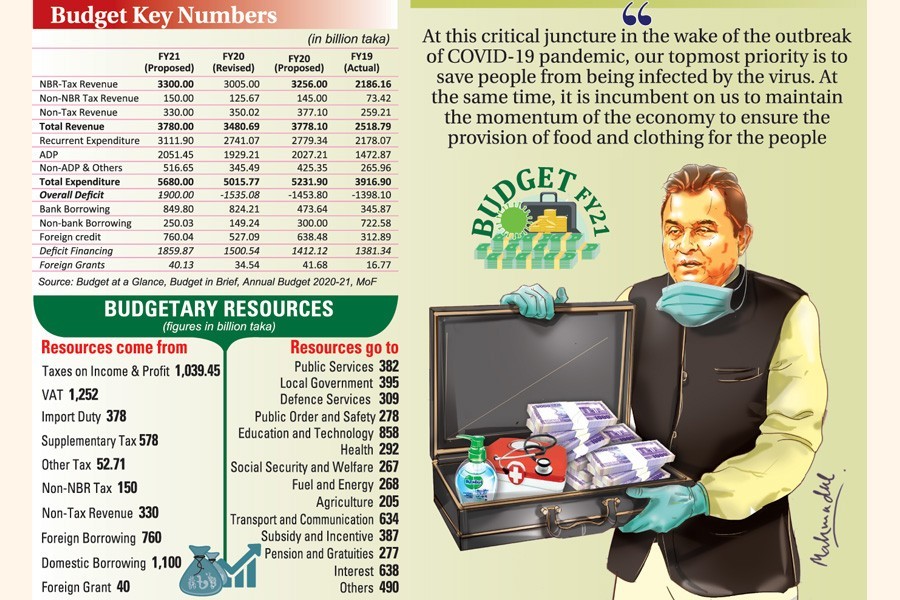

The size of the proposed budget is bigger by Tk. 660 billion from the revised one for the outgoing fiscal and the deficit has been estimated at 6.0 per cent of the gross domestic product (GDP). Most part of the deficit will be met through borrowing from foreign sources and domestic banks. The plan to borrow nearly Tk. 850 billion would put additional pressure on banks that are already burdened with the a number of relief packages announced for various sectors of the economy.

However, the finance minister has set a few priorities right. Fighting Covid is, obviously, one that deserves the top most priority. The government, according to Mr. Kamal, has prepared a comprehensive plan that includes four main strategies. The first strategy relates to cutting of luxury expenditures and prioritizes government spending that creates jobs.

The government should have slashed allocations in the budget for large infrastructural projects that usually make little contribution to the job creation. Funds could have been diverted to labour-intensive projects in both rural and urban areas in the short-term.

The government, as expected, has rightly expanded the safety net programmes. This was necessary to reverse the poverty reduction trend triggered by the pandemic. The gain that the country achieved in poverty reduction during the last three decades is about to be erased because of the pandemic. But what remains a major challenge is taking the benefits of safety net programme to the target group of population.

There was a general expectation that the health sector would get a substantial volume of allocation in the proposed budget.

The government has raised allocation, but not up to the expectation of most people.

It is now widely believed that coronavirus will be staying with us for some more time. So, to deal with it, the government has deployed a substantial volume of resources to create more facilities for treatment of Covid patients and conduct research activities.

The finance minister has proposed a block allocation of Tk.100 billion to meet Covid-related emergencies. Besides, the government has taken up two projects at a cost of Tk 25 billion. The World Bank and the Asian Development Bank are providing funds for the projects.

Another notable aspect of the proposed budget is the opportunity offered to legalise undisclosed money and house property. The finance minister backed this move by saying, 'extraordinary time demand extraordinary measures'.

There has not been much uproar over the issue of legalising undisclosed money this time. Similar opportunity offered in the past budgets, however, did not bring much fiscal benefits for the government.

The budget offers tax benefits to the export-oriented industries, but it runs short of providing a guideline for those on how to survive the onslaught if the pandemic prolongs. The situation demands that the economy be made inward-looking for some time as a means to survive the pandemic.

The decline in remittance inflow has already created a negative effect on the demand situation in the economy. The proposed budget should have measures, fiscal or otherwise, to generate sufficient demand in the economy. However, it all depends on how long the pandemic rules over lives and livelihoods. The economy is unlikely to be on full gear with the pandemic remaining in place.

In such a fluid situation expecting the GDP to grow at a rate of 8.2 per cent in the next fiscal sounds unrealistic. The economy will surely rebound if the pandemic could be brought under control or stopped. But it all depends on successful development of a vaccine and its availability in Bangladesh. In fact, none is certain about it at this moment.