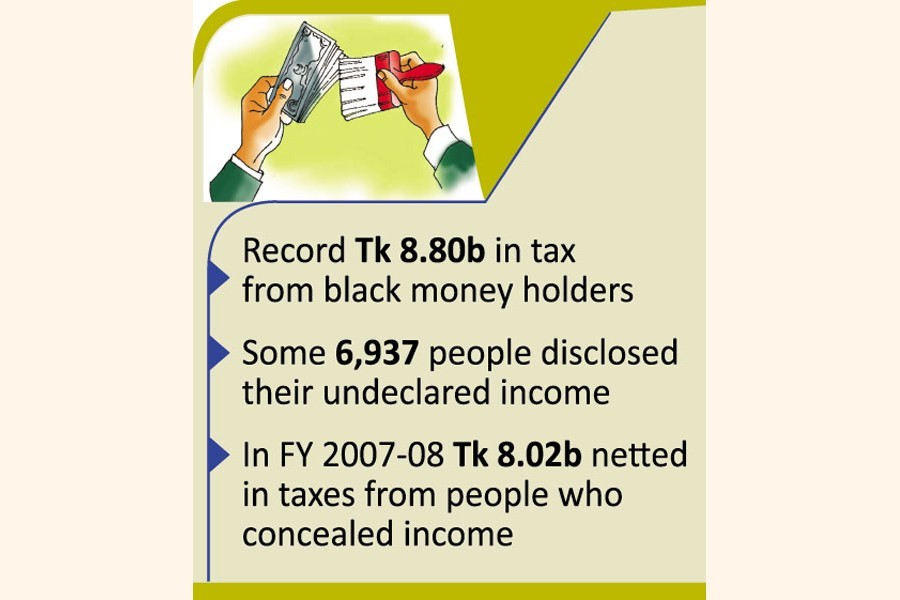

The government has received a record Tk 8.80 billion in tax from the holders of undisclosed money in the first half of the current fiscal year.

Between July and December, some 6,937 people disclosed their undeclared income availing the opportunity offered in the budget for FY 2020-21.

This represents the highest amount of tax the government has received since offering such an opportunity, according to data of the National Board of Revenue (NBR).

During FY 2007-08, then army-backed caretaker government netted Tk 8.02 billion in taxes from people who preferred to conceal their real income.

Income tax from individual taxpayers until December 30, 2020, amounted to Tk 37.69 billion paid by some 2.05 million people.

However, the number of tax returns will increase further as some 153,628 taxpayers submitted applications seeking the extension of time for filing returns.

The number of electronic TIN holders was 5.6 million until December 30, 2020.

Last year, the NBR received some 1.8 million tax returns with Tk 38.49 billion taxes.

The time for submission of tax returns by the individual taxpayers expired on December 31, 2020. The original deadline was November 30. But it was extended by one month later.

As per NBR data, some 188 people disclosed their undeclared income in the capital market from July 1, 2020 to December 30, paying Tk 225 million taxes.

Some 6,749 undisclosed income holders paid Tk 8.58 billion in this period by investing their income in land, flats and other areas, the NBR data said.

The government offered a blanket opportunity to formalise undisclosed income in the current fiscal paying 10 per cent tax at flat rate.

In the current fiscal, people will be able to invest their undisclosed money in cash, debenture, securities, share market, land, apartments, etc without facing any question from the taxmen.

Talking to the FE, distinguished fellow of the Centre for Policy Dialogue (CPD) professor Mustafizur Rahman said such an opportunity discourages regular taxpayers as they pay taxes at a higher rate.

It is neither politically nor legally fair to offer such an opportunity where the tax rate would be less than that of regular taxpayers, he argued.

There should be a penal amount of tax in addition to the normal tax rate for the unethical behaviour, he said.

He said the NBR received this degree of response from undisclosed money holders during the caretaker government's regime.