Agent banking has gained popularity among the people in remote areas of the country and, as of July this year, around 3 million marginalised people are taking banking services from the agent outlets.

National Consultant for the Digital Access of Financial Services of a2i programme of the government Iqbal Hossain Sohel said agent banking has become the key point for the rural economy, reports BSS.

He said deposit mobilisation has received momentum and the remitters are now also opting for the platform largely as the beneficiaries can withdraw funds without visiting any bank branch.

As of July 2021, he said, marginalised people are getting banking services from a total of 4,470 digital centres across the country.

Till July 2021, he said, the total amount of deposit collection stood at Taka 13.7 billion while agent outlets disbursed Taka 19.6 billion in remittance.

Iqbal Hossain Sohel said rural and underserved communities face significant challenges in accessing financial services and they still need to travel a significant distance, spend considerable amounts of money and time to receive financial services as their nearest bank branch is often too far away.

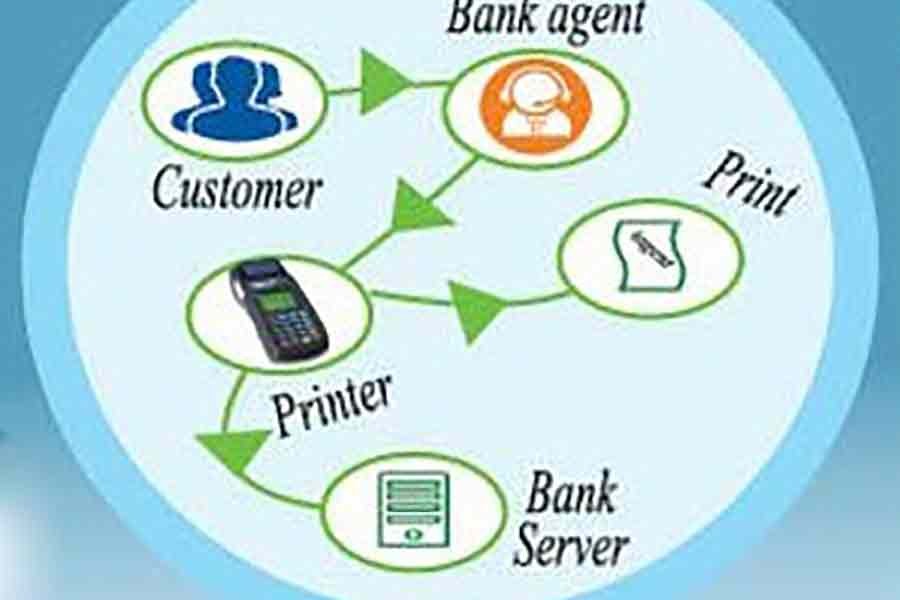

To overcome this situation, he said, a2i has intervened with a digital centre-based agent banking model where existing entrepreneurs of digital centres become bank agents to offer financial services to hard-to-reach customers.

With the combination of technology and agent network, digital centre entrepreneurs are now capable of providing banking services in rural areas to the marginalised and deprived community, he added.

Iqbal Hossain Sohel said the objectives of agent banking are to include the unbanked rural population in the formal banking system and provide access to various financial services through the digital centre.

A2i has introduced the service to save time and money for citizens by offering financial services from the nearest agent points, he added.

Prime Minister Sheikh Hasina from her office and former New Zealand Prime Minister and Global Administrator of UNDP Helen Clark from Char Kukri Mukri jointly inaugurated the Union Information and Service Centre (Digital Centre) across the country through a videoconference on 11 November 2010.

In the continuation of the success of Union Digital Centre in 2013, digital centres were established in all wards of municipalities and city corporations.

About 294 digital services are currently being delivered to the rural people by the union digital centres, said Iqbal Hossain Sohel.