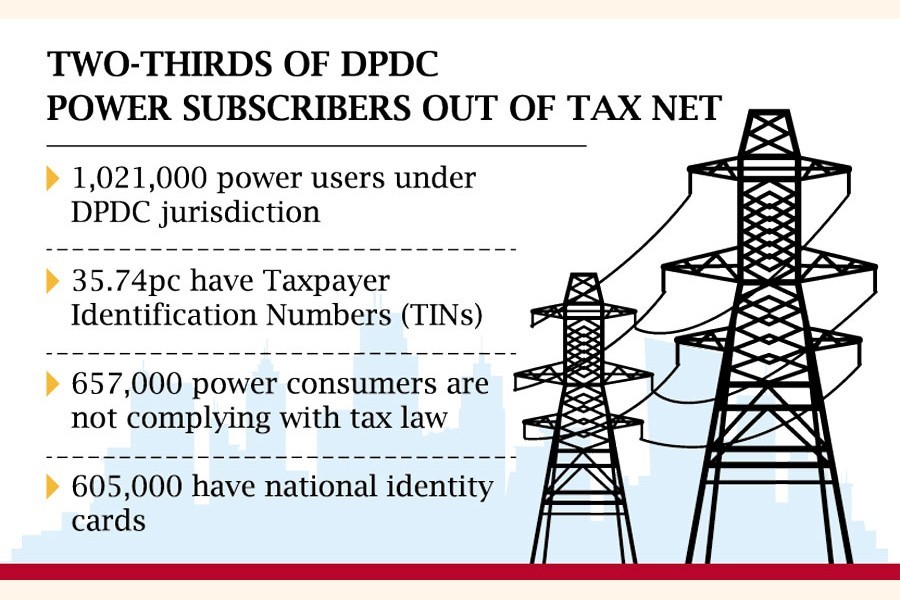

Power usage now becomes a parameter of wide-scale tax delinquency in Bangladesh as nearly two-thirds of electricity consumers under Dhaka Power Distribution Company (DPDC) are found having no tax registration.

There are a total of 1,021,000 power users under the DPDC jurisdiction in the capital city, Dhaka, and adjoining Narayanganj area. Of them, 365,000 have TIN, a study by the National Board of Revenue (NBR) revealed Thursday in the process of hunting out potential taxpayers.

It shows only 35.74 per cent of total power consumers who live in Dhaka South City Corporation and in a part of Narayanganj district have Taxpayer Identification Number (TIN).

At a memorandum of understanding (MoU)-signing ceremony between the NBR and the DPDC, the NBR high-ups hoped that the number of taxpayers would jump to 240,000 instantly through exchange of information between the entities.

Currently, a total of 657,000 power consumers under DPDC are not complying with the tax law although 605,000 have national identity card, showed the slides presented by Niaz Morshed, second secretary at the revenue board's income-tax wing.

Speaking at the MoU-signing ceremony on the NBR premises, NBR Chairman Abu Hena Md Rahmatul Muneem said each of the household and car owners in the city have to submit tax return irrespective of having or not taxable income.

"If anyone has less than taxable income, they can easily show it in the tax returns," he added.

The NBR joined hands with DPDC in a bid to make taxpayers compliant on the basis of data and information of their wealth and income, he told the function.

"No one would be able to deny if taxmen ask to pay tax pointing out the wealth," he added.

He said door-to-door survey is not a feasible method for finding new taxpayers rather taxmen can focus on policy formulation to find strategies to expand tax net.

He appreciated DPDC's cooperation with the NBR in the bid for expanding tax net so that the NBR can contribute more to financing development works.

Pradyut Kumar Sarkar, Member (tax audit, intelligence and investigation), delivered welcome remarks at the programme and appreciated homegrown innovation of NBR officials on digitization of the income-tax wing.

DPDC Managing Director Bikash Dewan said the company is capable of delivering fast services to the consumers but recently it is rationing power due to austerity move of the government.

Md Habibur Rahman, Secretary of the Power Division, said as per Bangladesh Bureau of Statistics (BBS) some 3.5 million belong to middle-class group so they are capable of paying tax.

"It is universal tendency of people to avoid payment of tax. We have created environment to make tax evasion difficult for them," he said.

NBR member (tax information, management and services) Md Jahid Hassan said taxpayers would also be benefited from the exchange of information as they will be able to show data of less use of power in case of their rented house remaining vacant for two-three months.

System Manager of the NBR Ziaul Huq said the tax authority will be able to access data of power consumers up to 72 months under the integration through the interface.

Fazlur Rahman, system manager of the NBR, and Md Asaduzzaman, deputy secretary and company secretary of DPDC, signed deal on behalf of their respective organization.

Already the NBR has partnered the Election Commission, Bangladesh Road Transport Authority, Bangladesh Financial Intelligence Unit (BFIU), National Savings Directorate, Bangladesh Investment Development Authority, Bangladesh Export Processing Zones Authority, Ibas (software) of the ministry of finance etc in the drive for hooking new taxpayers onto the net.