Cooling soaring prices should be prioritised in the upcoming budget, considering erosion of purchasing power of low-income people, says a think-tank and suggests tax breaks and currency stabilising as basics of budgeting.

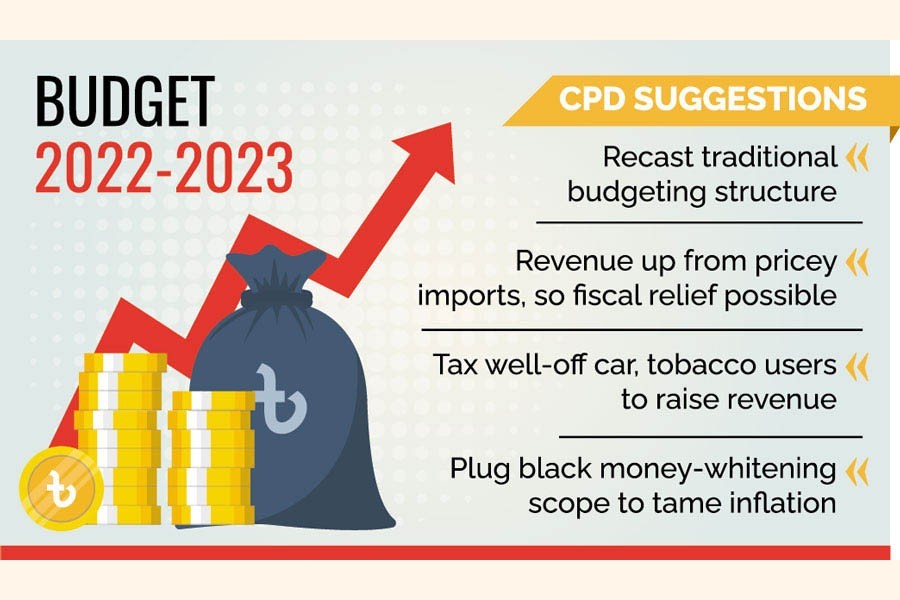

With this end in view the new budget should come up with structural changes in traditional fiscal measures for the period of exigencies, researchers in the Centre for Policy Dialogue (CPD) said Tuesday.

They think the price situation has to be controlled giving tax breaks on import and domestic fronts, stabilising the currency- exchange rate.

Placing recommendations for the national budget 2022-23 at the CPD office, Dr Fahmida Khatun, Executive Director of the CPD, said the main focus of the upcoming budget should be redistribution of income to the underprivileged people to feed them by ensuring other basic rights and minimizing income inequality.

Dr Fahmida finds the inflation rate cited in government data inconsistent with the price situation on the local market.

"The base year of inflation calculation is fixed on the basis of consumption basket in 2005 while pattern of consumptions has been changed in the last 17 years," she told the press meet.

Prof Mustafizur Rahman, distinguished fellow of the CPD, notes that the government is framing the budget in a different situation now. "Marginal people are now facing blow of the price hike due to the Russia-Ukraine war when they were just started recovering from the Covid impact."

He said the prices of commodity would be cooled down after certain time as it is transitory in nature but at this stage budgetary support is required.

"As it would be the full-fledged national budget before national elections, tax and loan defaulters should not be spared or encouraged with the measures like black money-whitening or loan-rescheduling schemes," he observed.

He feels that the black money-whitening scheme should be discontinued as it gives other signal against mobilizing resources through combating corruption.

The policy researcher thinks that the current situation of Bangladesh is not alarming to face Sri Lanka-like syndrome, but cautious steps should be taken on foreign loan and its repayment- timeframe contracts.

He forecasts that trade deficit may soar to US$30 billion by June next, which would exert pressure on current-account balance.

Dr Khondker Golam Moazzem, CPD Research Director, finds the price situation worrisome and says it should be taken into consideration in the next budget.

"The next four to five years is important, too, for Bangladesh before and after graduation," he said.

Towfiqul Islsm Khan, senior research fellow and also coordinator of the CPD IRBD (independent review of Bangladesh's development) 2022 team, reminded that the National Board of Revenue (NBR) is not a profit-making entity to focus on tax collection only ignoring purchasing power of common people.

Tax collection in import stages is increasing following price hike of commodities, which would offset the revenue loss for giving tax relief, he notes.

"Tax collection from well-off sections of people having car or tobacco users could be geared up in the budget," he suggests.

Dr Fahmida urged the government to set realistic revenue-collection target and lay emphasis on institutional capacity building.

She suggests increasing tax-free ceiling for individual taxpayers to Tk 350,000, reinstating 30-per cent highest tax slab for well-off people, setting 30-per cent corporate-tax rate for One Person, Company, review of the incentives for export-oriented sectors, phasing out tax-holiday facilitates from some sectors to offer new sectors that are still lagging behind.

Reforming the existing revenue structure and expediting finalising new income tax and customs laws are also needed, she said.

To check money laundering and capital flight, the transfer-pricing cell of the NBR could be integrated with the Bangladesh Bank, she added.

She suggests adopting austerity on approval for new projects to cut expenditures in a belt-tightening measure.

Syndication, hoarding, intervention of middlemen and transportation cost are related to the commodity-price rise, she notes.

The CPD suggests strengthening the role of competition commission to control the wayward price situation with market information or steps to be taken.

Under the current situation, the government must provide subsidies on fertilizer and agriculture inputs.

However, distribution of the subsidies to the farmers has to be ensured, the CPD proposal says.

Dr Fahmida suggested continuing 2.0-per cent incentives to the remittance-earners and keeping currency-exchange rate stable considering price spiral of commodities.

For graduation from the least-developed-country status by 2026, the government has to restructure its subsidy-providing strategies in a creative way.

She suggests the government to refrain from second-phase stimulus package distribution until the first phase competed as many of the marginal people were yet to receive loan support.

Prof Rahman suggests showing zero tolerance to the tax and loan defaulters and not offering any benefits to them before the next polls.

"New projects should be taken cautiously while existing ones have to be completed on the basis of priority," he said.

The CPD proposes shutdown of the losing state-owned enterprises, not to signing new contracts on costly independent power plant, diverting dependencies on fossil fuels to renewable energy, planning carbon tax from 2026, focusing environmental issues, tax cuts on education, increasing health and education budget, and excluding pension fund from social-safety net.

Also, it recommends increasing social safety-net allowances, bringing urban poor under the safety net, investing more on child development and labour wellbeing.

The think-tank hopes that the government will look at the next budget as an opportunity to secure the wellbeing of marginalized people, revive the Covid-impacted economy and stimulate private-sector investment.