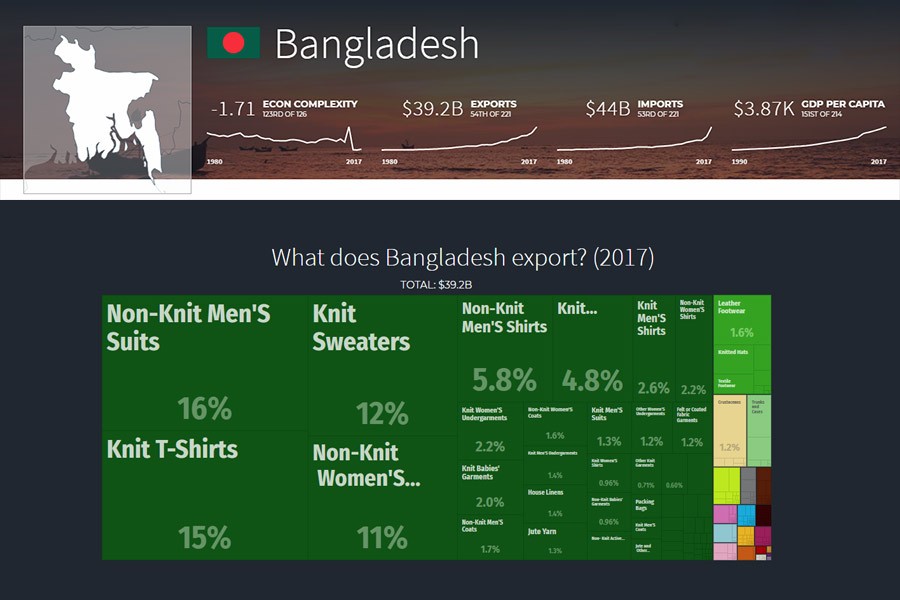

Bangladesh's 25-notch fall---from 98th position in 2008 to 123rd in 2017--- among 129 countries in the global Economic Complexity Index (ECI) ranking is certainly worrying. The ECI, developed by two US university professors, measures productive capabilities of individual countries in terms of the mix of products that they export. Seen rather plainly, the decline in the ECI ranking does not match the progress that the country had made in exports, in terms of both value and volume, during the period under review. In fact, the uptrend in exports is continuing, albeit at a reduced pace.

Still, there must be some reasons for the ECI to downgrade Bangladesh. It is important here to note that the Index takes data on exports and reduces the relevant country's economic system into a couple of dimensions. They are: (a) export products' diversity in a competitive environment and, (b) number of countries competing for any particular export item in the global market. The countries that export a very few items and face stiff competition in the global market are regarded the least 'complex' and placed at the bottom of the ECI.

Bangladesh, naturally, gets a place there because its export-base is very narrow and one single item---readymade garments (RMG)--- dominates nearly 82 per cent of the total export basket. Other notable export items are leather and leather goods, frozen foods and jute. Barring jute, all other items do face strong competition from a good number of producers. Besides, export growth of leather items and frozen foods has been on a declining path in recent years. As far as jute is concerned, the demand has been subdued.

Besides, there is a correlation between ranking in ECI and GDP (gross domestic product); the countries placed at the lower rung of the Index do have lower GDP and the opposite happens for those placed in the upper level. Bangladesh can improve on its present position only through appropriate diversification of its exports because of the fact that different types of exports do produce different economic outcomes. For instance, overall outcome, financial or otherwise, of export items manufactured using local raw materials will be different from the ones that are largely dependent on imported ingredients.

The role of the manufacturing sector in areas of export, import and employment cannot be overemphasised. The development of manufacturing along with efforts to ensure higher productivity is very important for achieving higher economic growth. Thus, the relevant policymakers do need to remove the hurdles in the way of productivity growth side by side choosing the right kind of manufacturing industries that would meet both domestic demand and help diversify exports. This task will, however, not be that easy.

Unfortunately, despite widespread concern expressed by all relevant parties, Bangladesh export basket contains a small number of goods that are in high demand globally. The basic reasons for the country remaining stuck-up in one place are known to all. Yet nothing tangible is being done to address those. Unless something substantive is done at the level of government policymakers and businesses at the earliest, the country might find itself in a difficult situation as far as exports are concerned. It is expected that all stakeholders would realise this fact.