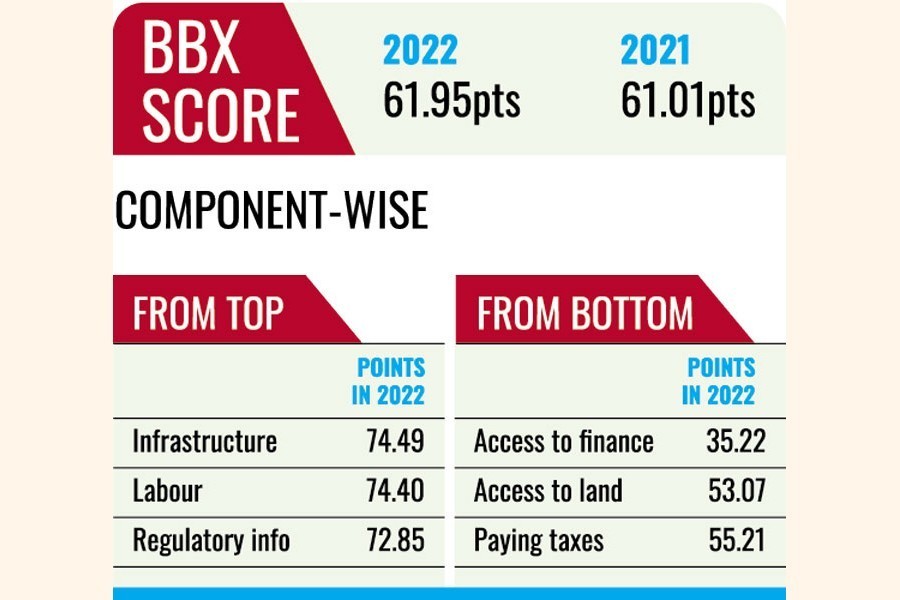

The second edition of the country's first home-grown index, jointly formulated by the Metropolitan Chamber of Commerce & Industry (MCCI), Dhaka, and the Policy Exchange , Bangladesh, has referred to a mixed performance as far as the ease of doing business is concerned. The index, known as the Bangladesh Business Climate Index (BBX), unveiled in Dhaka on Thursday, has primarily assessed the business atmosphere on the basis of a survey of 518 qualified responses in July-September period of 2022, on 10 major categories, including businesses' access to land, availability of regulatory information, infrastructure, labour, trade facilitation, technology adoption, and access to finance. Survey results showed significant gains in infrastructure, labour and regulatory information, but businesses faced major impediments in areas of access to finance and land and tax payments. One interesting fact that featured in the index was the coming of age of smaller urban centres like Mymensingh, which actually outshone both Dhaka and Chittagong. This gives hope that urbanisation will not remain confined to the two major cities in the years to come.

While it is highly commendable that Bangladesh has done well on most categories, the areas that fared poorly in the index need much greater attention than now. Looking at access to finance, which scored the lowest, is coming mainly from the hurdles faced by the country's small & medium enterprises (SMEs). These entities face many hurdles in getting loans since financial institutions have many requirements and administrative procedures (documentary requirements), considered too cumbersome for SMEs to navigate. When one looks at the requirements for availing the credit guarantee scheme launched by the central bank, a company is required to obtain environmental clearance, a year-long business plan and financial statement. These requirements need to be reworked since a large percentage of SMEs don't fit into this model of checklist. Smaller enterprises are hamstrung by mandatory requirements that ought not be applied to these smaller size of enterprises. Similarly, the question of collateral has to be addressed at policy level because one size simply does not fit all. Given the nature of SMEs, tailored requirements must be put in place, otherwise SMEs will remain largely outside the purview of adequate finance to grow their businesses.

There are other festering issues that need to be resolved if the country wishes to compete with regional rivals for FDI. Although Bangladesh Investment Development Authority (BIDA) is presently providing 152 types of services of 23 agencies, it is felt that all regulatory requirements including permissions for foreign investors need to come under BIDA for it to be truly a "one-stop service". There is also the matter of settling disputes. Unfortunately, as pointed out by a former president of MCCI, it takes about 1,463 days to get to the first level of judgement in a commercial case, whereas it is only 79 days in Singapore. Whilst it may not figure large on the radar, this is something investors enquire about. While there is much to celebrate, the fact is that those indicators that are not doing well are the ones that require the greatest attention. Time, unfortunately, is the one thing that is not on Bangladesh's side. As the world re-emerges from the slumber of Covid, with China coming into full swing and returning to the global market, where would Bangladesh like to see itself? There are serious contenders for FDI in Asia. And, for the country to be at the top of the game, it needs to pull up the struggling indicators.