An estimated Tk 6.78 trillion worth of expansionary budget is coming tomorrow (Thursday) with government sights set on higher targets, amid soaring prices and inflationary pressures on the economy.

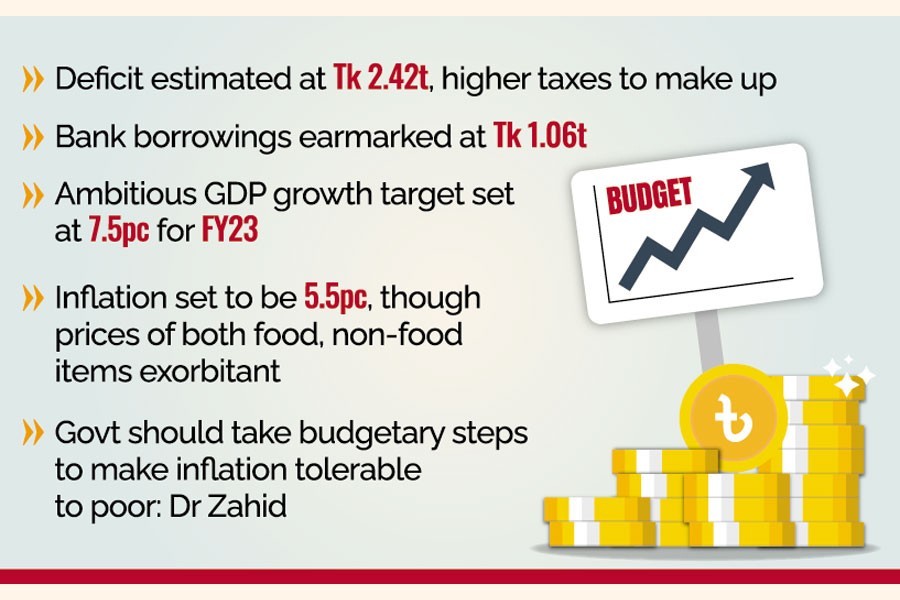

The government has set an ambitious target of gross domestic product (GDP) growth at 7.5 per cent for fiscal 2022-23, sources said.

Finance Minister AHM Mustafa Kamal is set to unveil Bangladesh's annual budget for the upcoming fiscal year FY 2022-23 in parliament.

Sources say the finance minister is likely to place the budget with an outlay of Tk 6.78 trillion, up over 14 per cent from the current fiscal year's revised-budget estimation, along with the finance bill 2022 to give his calculations legal cover.

Budget deficit has been estimated at 5.5 per cent of the GDP or Tk 2.42 trillion. The deficit is slightly up in terms of GDP, but it is quite higher when assumed in absolute amounts.

The total resource mobilization, including NBR resources, has been estimated at Tk 4.36 trillion or 11 per cent higher than the revised budget of the current fiscal year, FY 2021-22, according to sources familiar with the budgeting at the finance division.

They also say the government has estimated Tk 3.7 trillion worth of revenues from the NBR- controlled taxes while Tk 450 billion from non-tax revues: fees, tolls and dividends from government-owned entities. Besides, the government expects Tk 32.71 billion as grants which do need to be repaid.

The government plans to borrow from the banking system Tk 1.06 trillion to feed the next expansionary budget which is up nearly 22 per cent from the revised budget.

The borrowing or financing from the national savings schemes has been earmarked at Tk 350 billion, up by Tk 30 billion or over 9.0 per cent than the revised budget estimation.

The government apparently discourages people from investing in the government borrowing instrument titled Sanchayapatra. It discourages through mandatory requirement of TIN and NID for investing in the risk-free national savings schemes.

The sources said the finance minister would place the annual budget with an inflation target of 5.5 per cent for the next fiscal year, although prices of both food and non-food items remained at an elevated level, eroding people's real income.

Many economists view that the expansionary budget may fuel up the inflationary pressures on the economy. But they also say if the government spends on the subsidy and social protections that will be good as such measures will help keep the inflation tolerable to the poor and limited- income-bracket people.

Dr Zahid Hussain, a former lead economist of the World Bank (WB), told the FE: "In my view, such big budget may fuel up the inflation in the economy which already has hit hard the limited- income group of people."

He notes that many people have gone below the poverty line as a result of the recent inflation which officially remained between 5.0 and 6.0 per cent.

He suggests that the government take steps in the budget on how to make inflation tolerable to the poor.

Dr Masrur Reaz, chairman of the Policy Exchange of Bangladesh, told the FE that if the government allocates funds for protection of the poor amid the growing inflation, it will be the right direction.

If the government spends on unnecessary and unproductive sectors that will bode bad for the economy.

Inflation has been increasing gradually since October last. The point-to-point inflation shot up to 6.29 per cent in April-the highest in 18 months. It was 6.22 per cent in March.

He feels that the country may face even higher inflation in the near future, say, six to nine months, because of the higher prices of imported goods and other consumable items owing to the higher US dollar exchange rate alongside the higher global prices.

"To my mind, the expansionary budget will be justified if funds are allocated for reduction in the pressure of inflation, otherwise it will create huge pressures through price surges of the food and non-food goods," he says.