Warren Buffett has long championed looking at market capitalisation to GDP (gross domestic product) ratio when assessing a market. For Buffett, the "single best" way to tell if stocks are too expensive is to look at the total value of all equities in the market relative to the total size of the economy, reports frontera.net Thursday.

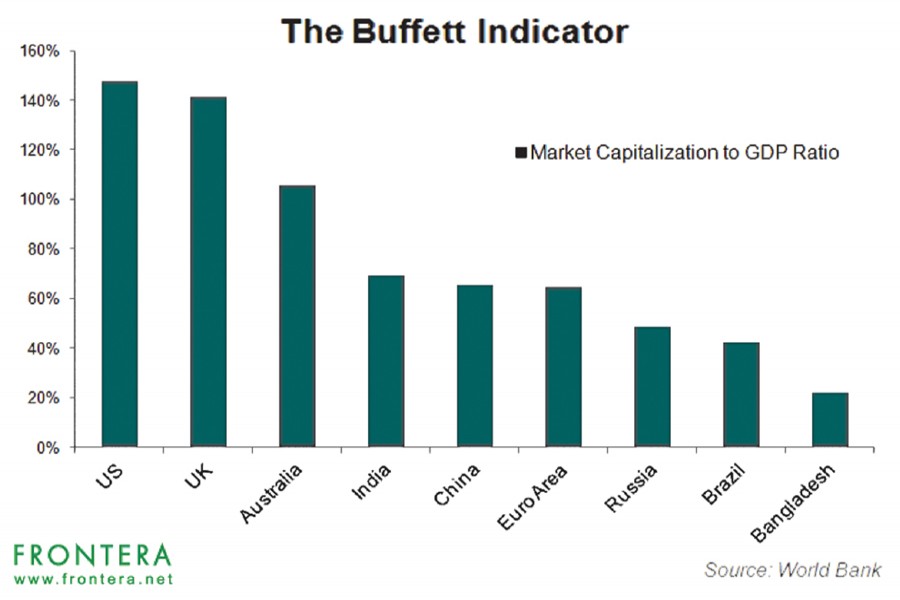

Looking at the developing markets (EEM) (FM) in particular; markets such as China (FXI), India (EPI), Brazil (EWZ), and Russia (RSX) had Buffett indicators at 65.4%, 69.2%, 42.2%, and 48.5% (market capitalisation of listed domestic companies to GDP ratio), respectively as of 2016. In comparison, developed markets such as the US, UK and Australia, had market cap to GDP ratios of 147.3%, 141.2%, and 105.3%, respectively.

Bangladesh lags far behind by the standards of this indicator with a 22% market cap to GDP ratio, Majedur Rahman, Managing Director of the Dhaka Stock Exchange told Frontera during a recent conversation.

"Bangladesh's GDP is about $250 billion, whereas its market capitalisation is about $52 billion. Back in 2010, the market cap to GDP ratio was 40%. So, we're pretty far behind compared to other South Asian markets," said Rahman.

He expects the Bangladeshi government's focus and listing interest from the corporate sector to drive this ratio up to at least 40% in 3-5 years.