Foreign-aid flow into Bangladesh ebbed down in the first quarter (Q1) of the current fiscal as key multilateral donors appeared generous on pledge but tightfisted on fund disbursement, officials say.

The aid disbursement dropped 30.38 per cent by official count during the July-September period of the fiscal year 2022-23 compared to the same period last fiscal, when the country faces a foreign-exchange crunch.

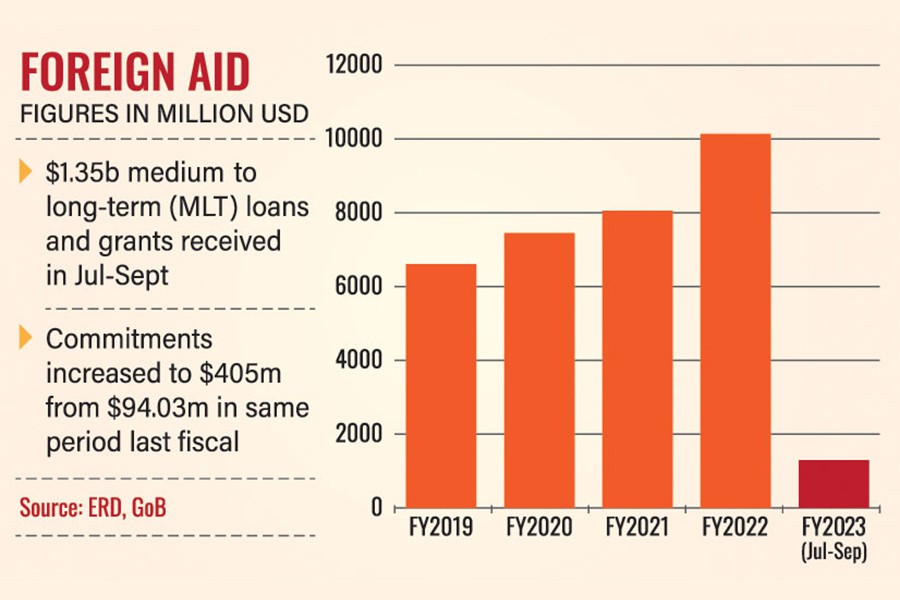

Economic Relations Division (ERD) data show during the Q1 of the current FY2023, bilateral and multilateral development partners disbursed US$1.35 billion worth of medium-to long-term (MLT) loans and grants.

In the same period last FY2022, the development partners, including the World Bank, the Asian Development Bank, Japan and others, disbursed $1.94 billion worth of assistance.

In the Q1 of the previous FY2021, the multilateral and bilateral development partners provided $1.44 billion in foreign assistance, ERD data show.

Meanwhile, the foreign-aid commitments during the first quarter of the current fiscal year increased to $405 million compared to $94.03 million in the same period last FY2022, the ERD data showed.

An FE analysis finds that the overseas development assistance (ODA) to Bangladesh has dropped for the first time after long years while the country is facing crisis of foreign exchange following significant fall in reserves, largely attributed to the current global crunch.

According to the analysis, the MLTs and grants had been on a crescendo since FY2011 with the country having received higher assistance year on year.

For the first time, foreign assistance could shrink in the current FY2023 particularly as the government has already gone for austerity in its spending on development projects leaving out less-priority ones in a belt-tightening measure.

Meanwhile, an ERD official told the FE that although the foreign assistance had plunged in the Q1, the receipts might climb higher at the end of the fiscal.

In the last FY2022, the development partners disbursed a record-highest amount of $10.0 billion in foreign aid, ERD data showed.

In the previous FY2021, the development partners had released $7.96 billion worth of assistance.

The development financiers, including the ADB, the World Bank, Japanese donor JICA, China, and the Islamic Development Bank, disbursed concessional aid every year for the development of Bangladesh.

The FE analysis has found that Bangladesh's largest bilateral development financier, JICA, has played a vital role in the foreign-aid inflow to Bangladesh in the Q1 under review.

JICA alone provided $459.33 million during the July-September period of the current fiscal.

Besides, China disbursed $274.79 million, the World Bank $192.13 million, the ADB $167.98 million, India $101.59 million and Russia $74.68 million, ERD data show.

Out of the total $1.35 billion released during the past quarter, the development partners disbursed $1.33 billion in loans and $12.50 million as grants, the ERD statistics show.

Executive Director of Policy Research Institute (PRI) Dr Ahsan H Mansur told the FE that as the government received some emergency budget and policy supports from the WB, the ADB, Japan, the AIIB and other donors, the overall aid inflow was higher.

"If the government fails to convince the International Monetary Fund (IMF) and other multilateral and bilateral donors with necessary reforms, the foreign-aid disbursement at the end this fiscal may not cross the amount of the last FY2022," he said.

Dr Mansur suggests the government should go for necessary reforms for getting IMF's $4.5- billion budget support.

Meanwhile, the government repaid $525.61 million in interest and principal for debt servicing during the July-September period of the FY2023.

Out of the debt-servicing amount, the government paid $388.58 million as principal of the outstanding loans while $137.03 million as interest thereon.