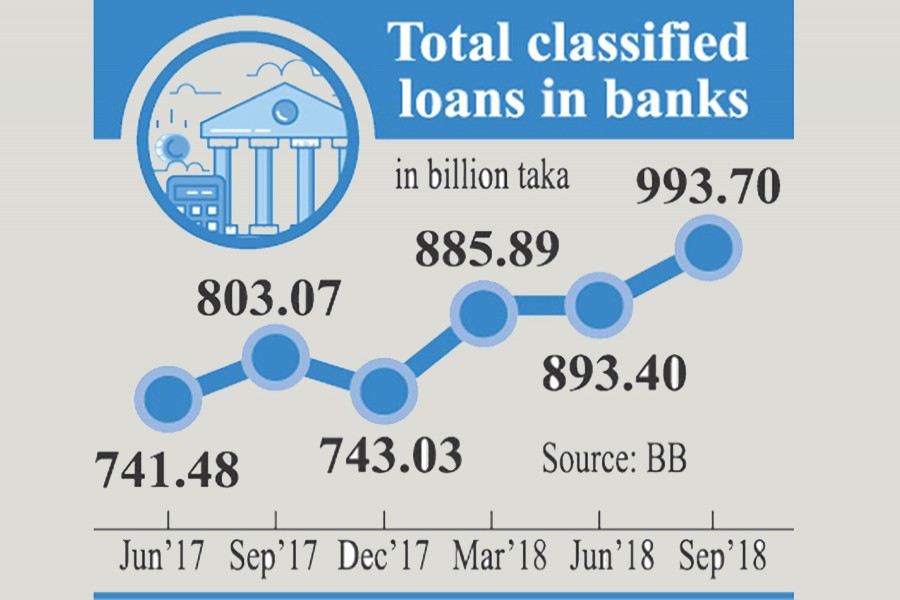

The amount of classified loans in the country's banking sector reached an all-time high of nearly Tk 1.0 trillion in September ahead of the upcoming national election.

The volume of non-performing loans (NPLs) jumped by nearly 34 per cent or Tk 250.67 billion to Tk 993.70 billion as on September 30, from Tk 743.03 billion as on December 31, 2017 despite close monitoring of the central bank.

The amount of classified loans was Tk 803.07 billion a year before.

Former Governor of Bangladesh Bank (BB) Salehuddin Ahmed opined that the next government should address the issue with top priority to continue the country's ongoing economic activities.

"Entire economy may face a negative impact, if the country's banking sector is in trouble," Dr. Ahmed told the FE while explaining the possible impacts of such a huge volume of NPLs.

However, the amount of NPLs increased by more than 11 per cent or Tk 100.30 billion to Tk 993.70 billion during the third quarter (Q3) of this calendar year, from Tk 893.40 billion in the preceding quarter (Q2), according to BB's latest statistics.

The share of classified loans also rose to 11.45 per cent of the total outstanding loans during the period under review from 9.31 per cent nine months ago.

The default loans include substandard, doubtful and bad/loss of total outstanding credits, which stood at Tk 8,680.07 billion as on September 30, 2018, from Tk 7,981.96 billion as on December 31, 2017. It was Tk 7,527.30 billion as on September 2017.

Senior bankers as well as the central bankers said the amount of classified loans in the banking system has increased during the period under review, as some borrowers did not make repayment of installments against their rescheduled loans.

They also said a portion of restructured large loans has already turned into classified ones that also pushed up the overall volume of NPLs in the banking system.

The central bank cleared proposals of 11 business groups for restructuring their large loans amounting to around Tk 153.26 billion.

A total of 22 commercial banks had earlier forwarded the proposals to BB for approving the loan restructuring on behalf of their clients.

"We expect that the volume of NPLs will decrease in the final quarter of this calendar year," BB executive director and spokesperson Md. Serajul Islam told the FE.

He also said the commercial banks will have to strengthen recovery drives across the country to reduce their volume of NPLs.

During the period, the total amount of NPLs with six state-owned commercial banks (SoCBs) rose to Tk 480.80 billion, from Tk 373.26 billion as on December 31, 2017. It was Tk 428.52 billion in Q2 of this calendar year.

On the other hand, the total amount of classified loans with 40 private commercial banks (PCBs) reached Tk 436.66 billion in Q3, from Tk 293.96 billion in the final quarter of last year. It was Tk 389.75 billion as on June 30.

The NPLs of nine foreign commercial banks (FCBs) rose to Tk 23.82 billion during the period under review, from Tk 21.54 billion in Q4 of 2017. It was Tk 22.71 billion in Q2 of this calendar year.

The classified loans with two specilised banks (SBs), however, came down to Tk 52.41 billion in Q3 of 2018, from Tk 54.26 billion nine months before. It was Tk 52.41 billion in Q2 of this calendar year.

Echoing the BB official, Syed Mahbubur Rahman, Chairman of Association of Bankers, Bangladesh (ABB), said the volume of NPLs will decline in Q4 of this calendar year following strengthening of overall recovery drives.

"Historically, the amount of NPLs drops in the final quarter of any calendar year," added Mr. Rahman, also Managing Director and Chief Executive Officer of Dhaka Bank Limited.