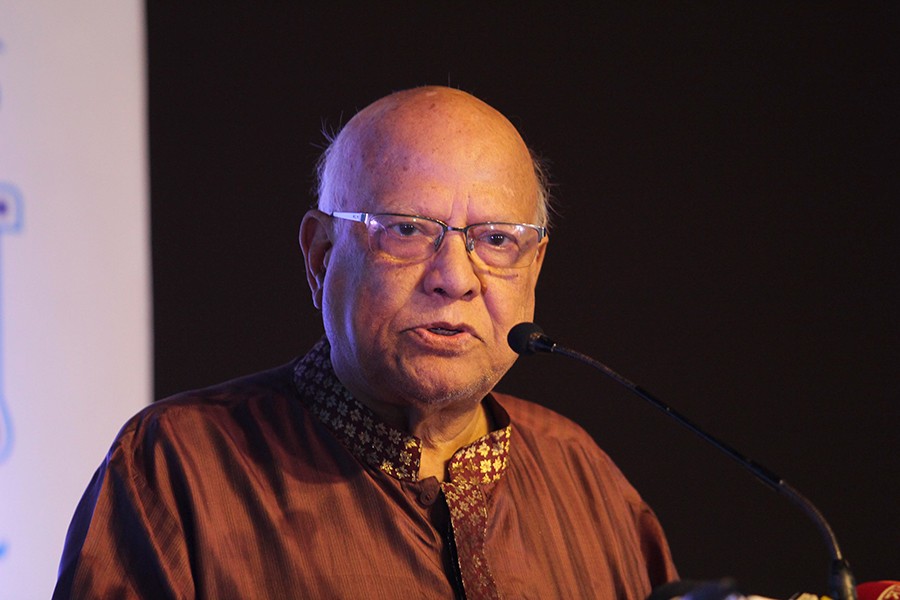

Finance Minister AMA Muhith slammed the National Board of Revenue (NBR) for offering tax exemptions on a large scale.

"The NBR might be called a jungle of tax exemption for providing too much of such facilities to various entities," he said on Tuesday.

Though the extent of such exemptions has been reduced than that of earlier, it should come down further, the minister added.

"I think I brought down the volume of tax exemptions significantly by various means during my tenure, but it should be trimmed down more."

Mr Muhith came up with the observations at a book launching ceremony held at the city's Dhaka Club.

The finance minister also observed that there is an incongruity between tariff value and real value of a product.

"We should say goodbye to tariff price of a product or lower the difference with real price to increase the government revenue."

There is a noticeable gap between various decisions taken by different government agencies and their real life implementation, he said.

The minister as the chief guest launched a book titled 'Rajoshsho Vabna: Jete Hobe Bohudur' (Thoughts over Revenue: Long Way to Go), authored by journalist Abu Kawsar.

The ceremony was also attended by Economic Affairs Adviser to Prime Minister Mashiur Rahman, former NBR chairmen including Abdul-Muyeed Chowdhury, Muhammad Abdul Mazid and Ghulam Rahman.

In his speech, Mr Muhith also said he closely worked on planning and finance in his six-decade career.

"So, many changes have taken place in the country's economic ambiance since the country's independence," he said.

He expected that the number of Taxpayer Identification Number (TIN) would increase to over 8.0 million from 3.7 million at present.

"Folk attitude about tax collectors turned more hospitable thanks to various initiatives taken by NBR in recent years," he said.

Mr Mashiur suggested that tax collectors adopt friendlier attitude towards taxpayers aiming to expand the revenue volume.

"We must not impose tax by any means which could hamper production," he said.

Mr Rahman laid emphasis on fixing linear tax rate aiming to make the tax assessment and collection process easier and transparent.

He also underscored the need for raising Bangladesh's tax-GDP ratio to around 20 per cent so that the government can spend money on various development activities easily.