Economists see the IMF nod regarding a US$4.5 billion worth of budget support as positive in coping with Bangladesh's prevailing economic shocks.

They also observed the IMF's willingness -- expressed after a thorough spot assessment of the country's creditworthiness -- as a positive indication that Bangladesh remains a good destination for the global lender.

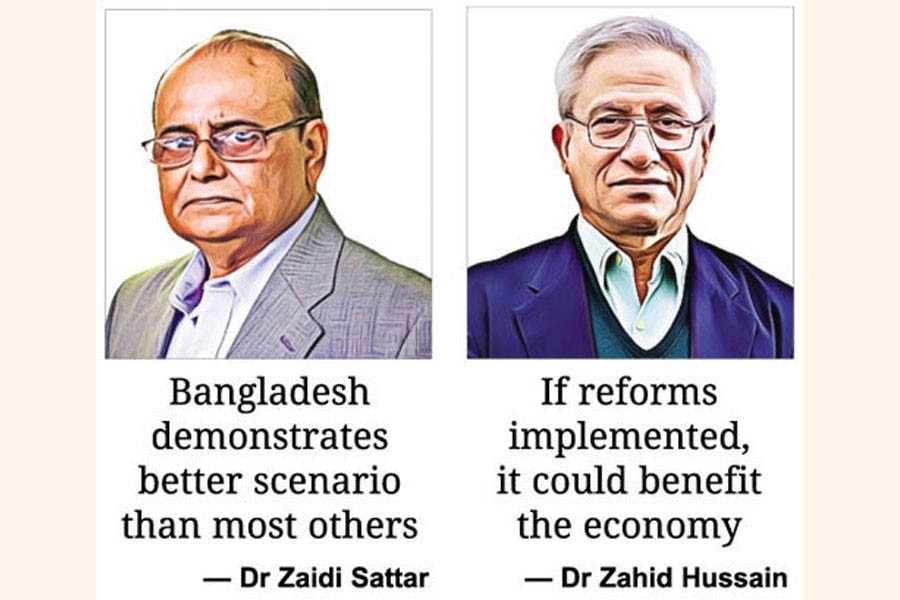

Policy Research Institute (PRI) Chairman Dr Zaidi Sattar Wednesday told the FE that since the IMF and the Bangladesh government reached an agreement on support to Bangladesh's economic policies and its reforms with the global lender's $4.5-billion loan, it would be a win-win deal for both parties.

The IMF in a statement Wednesday said the lender and the Bangladesh authorities reached a staff-level agreement to support Bangladesh's economic policies with a 42-month arrangement of about US$ 3.2 billion under the Extended Credit Facility (ECF) and the Extended Fund Facility (EFF) as well as of about US$1.3 billion under the Resilience and Sustainability Facility (RSF).

Dr Sattar says: "Between IMF and Bangladesh there is now a remarkable coterminous of interests: Bangladesh demonstrates relatively better state of fiscal, debt-management and BoP (balance of payments) scenario than most developing and emerging-market economies following the global economic shock; making Bangladesh a relatively attractive destination to park its funds for better returns on stability and growth."

For Bangladesh, IMF funds would be a preemptive and timely support to reach a comfort zone in its BoP and foreign-exchange-reserve levels - "a win-win for both parties".

Former World Bank (WB) Lead Economist Dr Zahid Hussain says it is difficult to comment on the IMF's proposed loan and the agreed points as "we do not know the matrix" for the programme.

"But it is true that the $4.5 billion proposed loan in six installments in 42 months will help a bit to the foreign- exchange reserve and give a fiscal space to the economy," he remarks.

Asked about Bangladesh's image after receiving the IMF loan, Dr Hussain says: "Some economy borrows the loan after falling into trouble and some economy takes the loan assuming shocks. Bangladesh is in the second category."

So, if Bangladesh now can implement the necessary reforms for getting the loan, it could bring benefit for the economy, the economist says.

Meanwhile, Bangladesh in July last formally sought budgetary support from the IMF assuming the shocks on the economy amid the Russia-Ukraine war and global scenario.

Bangladesh's foreign-exchange reserves dropped to $34.42 billion Monday, by official count.