The central bank of Bangladesh again raised the interest rate on a dollar loan from the EDF for manufacturers of exportable apparel, in an apparent measure to buttress the country's forex reserves.

Clothing exporters term the step ill-timed as the Bangladesh Bank Tuesday hiked the rate by 1.0 percentage point to 4.0 per cent on the US dollar loans from the Export Development Fund (EDF).

This is apparently to discourage lending from the fund and keep the falling reserves in a comfort zone. The country's foreign-exchange reserves are now below $35 billion if calculated with the EDF.

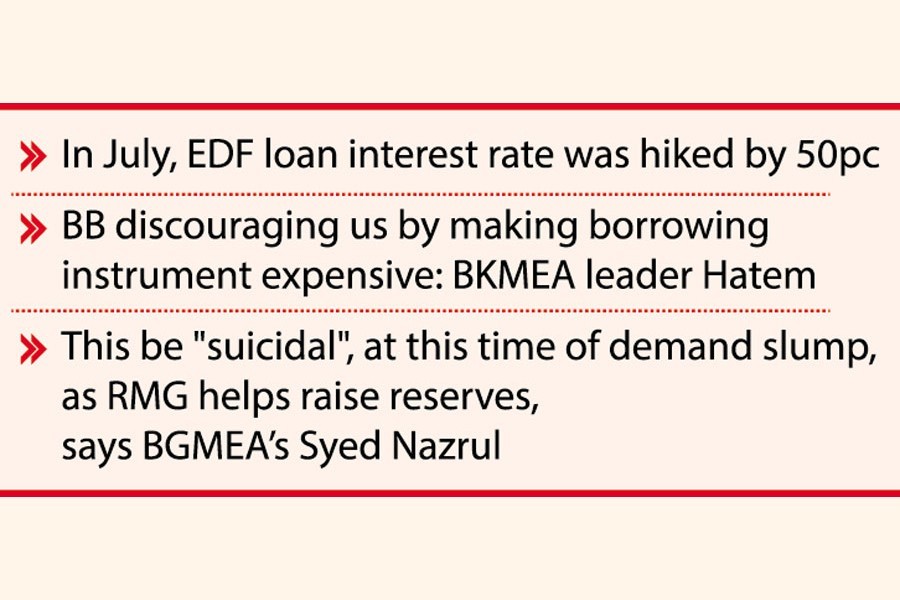

Earlier in July, the BB raised the interest rate on the loans made from the EDF by 50 per cent.

Now the central bank will charge 2.5-percent per annum (p.a.) and banks will charge 4.0 per cent p.a. on the loans extended to banks from the EDF.

The EDF is a special credit window created by the central bank to provide short-term finance in foreign currency for the import of raw materials by opening LC at sight by the export-oriented garment industries.

A BB circular raising the rate reads: foreign exchange Circular No. 17, dated July 20, 2022, in terms of which interest on EDF loans to Authorised Dealers (ADs) was charged by Bangladesh Bank at 1.50 per cent p.a., with the ADs charging 3.00 per cent pa on their USD loan disbursements to manufacturer-exporters.

"It has been decided that interest rate on EDF loans to ADs will be charged by Bangladesh Bank at 2.50 per cent p.a., while ADs will charge interest to manufacturer-exporters at 4.00 per cent pa."

The new rate is effective for disbursements from November 13, 2022.

"Other relevant instructions on the EDF shall remain unchanged," says the circular, signed by Director at the BB foreign-exchange policy department Md. Sarwar Hossain.

In the meantime, clothing exporters were dismayed over the decision as they feel this will make the production cost higher.

Md. Hatem, executive president of Bangladesh Knitwear Manufactures and Exporters Association (BKMEA), told the FE that this would have an adverse impact on the clothing shipments.

"Actually the central bank is now discouraging us by making the borrowing instrument expensive."

He says it will hurt the sector at a time when they have been struggling to survive amid plummeting demand for their goods, especially in Europe.

"We're now in trouble as the orders are falling on grounds of war in Ukraine coupled with shortages in power and gas supply."

Syed Nazrul Islam, first vice president of the clothing apex body--BGMEA--says this will be "suicidal" as garment exports help raise foreign-exchange reserves.

"This is not actually the right time as we have been facing multiple problems both at home and in our overseas market," Mr Islam, also Managing Director of Well Designers Ltd, a leading clothing maker of Bangladesh, told the FE about the government measure.

He said many orders were now on hold as the buyers want to take back those in the next season which will begin in March and onwards.

The apparel maker guesses that orders put on hold by buyers may range between 20 per cent and 30 per cent.

However, there is a debate over local uses of the EDF which actually is a part of foreign-exchange reserves.

The International Monetary Fund (IMF) argues that this amount should be deducted from the reserve accounting when the central bank uses it for its export boost.

The fund size is now US$7.0 billion.