Three sectors - cigarette, pharmaceuticals and mobile phone - made an impressive contribution to the government's revenue collection efforts during the first three quarters of the current fiscal year despite the disruptions being caused by the Covid pandemic to the country's economy.

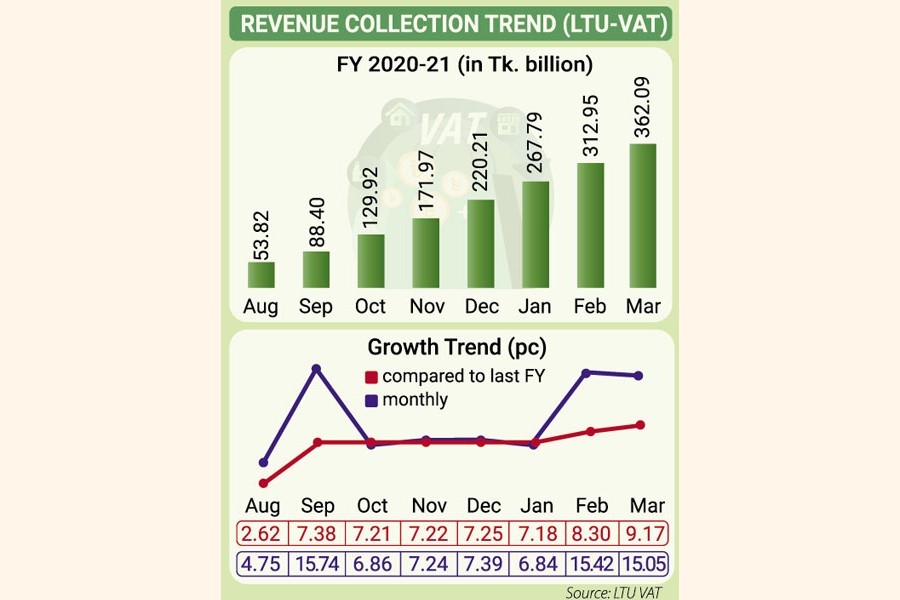

In the first three quarters of the current fiscal year (FY), 2020-21, VAT collection from large taxpayers grew by 9.17 per cent thanks to those three sectors, officials said. Cigarette industry was the largest contributor, as usual.

Taxpayers under the Large Taxpayers Unit (LTU) under the VAT wing contributed to the growth in revenue collection in July-March period of the FY'21.

VAT collection of the unit posted a 15 per cent growth in the month of March alone compared to that of the corresponding month last year, as per official data.

Until March, the unit collected Tk 30.40 billion more VAT than that of the previous FY.

VAT collection from cigarette companies stood at Tk 27 billion in March alone.

Revenue collection from mobile phone operators also increased to Tk 8.0 billion, as use of mobile phone surged significantly in this pandemic.

Pharmaceutical companies also paid higher VAT in the first three quarters, officials said.

Talking to the FE, LTU commissioner Wahida Rahman Chowdhury said the unit has been able to maintain an upward growth of VAT collection from large taxpayers despite the pandemic.

She also said the change in policy measure on reduction of VAT on spectrum and other fees to 7.5 per cent helped the government realise revenue without engaging in any dispute with the mobile phone operators.

"We have received additional Tk 1.0 billion VAT in the current FY because of the change in VAT measure."

Besides, it seemed that the Covid pandemic forced people to purchase more pharmaceutical items and safety gears, causing an increase in revenue of pharmaceuticals companies.

Ms Chowdhury noted that the ongoing lockdown made her worried over VAT collection in the month of April and onwards.

Some major sectors and entities, including large posh hotels, were facing severe blow to survive in the pandemic.

VAT collection from hotels and restaurants declined significantly during the last one year due to the virus outbreak.

She, however, expressed optimism over collecting higher VAT despite lockdown, as factories, banks and insurance companies remained opened during the period.

Ms Rahman added that the National Board of Revenue (NBR) should revise the cigarette-dependent tax policy.

A holistic approach in revenue collection, rather than the existing piecemeal type, is required to collect higher revenue.

However, increase in price of cigarettes and hike in Supplementary Duty (SD) levied in the budget also helped to collect higher revenue from cigarette sector.

Price of low-tier cigarettes increased by Tk 2.0 in the budget, while its SD rose to 57 per cent from 55 per cent.

On the other hand, tax and price slab of medium-tier cigarette remained unchanged, while prices for high-tier and premium quality increased by Tk 4.0 and Tk 5.0 respectively.

According to a provisional data, the LTU collected an aggregate amount of VAT worth Tk 362.09 billion against its target of Tk 469.32 billion.

However, the LTU achieved a record growth in the first three quarters of this FY compared to that of the same period in last three FYs.

Until March of FY 2018-19 and FY 2019-20, the unit achieved 1.36 per cent and 1.54 per cent growth respectively.

Although overall revenue collection of the NBR posted a negative growth in some of the months of the current FY, the LTU's VAT collection maintained an upward trend during the first nine months.