The central bank announced a new monetary policy statement (MPS) on Tuesday for promoting job-centric growth with a restraining approach to curb inflationary pressure on the economy.

Bangladesh Bank (BB) Governor Fazle Kabir unveiled the MPS for the July-December period of the fiscal year (FY) 2018-19 at a press conference at the central bank headquarters in Dhaka.

The MPS for the first half (H1) of the FY focuses on helping the sectors, particularly the productive ones, in achieving sustainable economic growth by reining in inflation.

"The monetary policy will be a restrained one like the previous one to facilitate economic growth and curb inflation," the BB Governor told reporters while formally announcing the MPS.

The central bank, however, kept unchanged its domestic credit (DC) target at 15.9 per cent for FY 19.

The target of broad money (M2) supply rose to 10.2 per cent for H1 of FY 19 and 12 per cent for H2, from 9.2 per cent of FY 18.

Such monetary targets of domestic credit and broad money are sufficient to accommodate real gross domestic product (GDP) growth of up to 7.8 per cent and average annual inflation of up to 5.8 per cent in FY 19, according to the MPS.

The BB projected the GDP growth ranging between 7.5 per cent and 7.7 per cent in FY 19, assuming a continuation of calm domestic political situation and no further escalation of global trade-related conflicts.

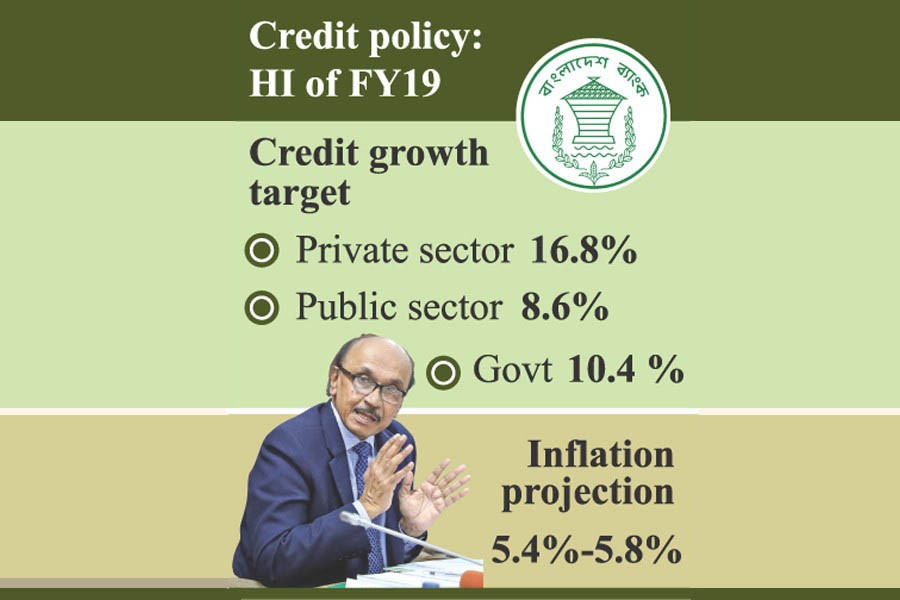

On the other hand, the central bank estimated the average inflation to be around 5.4-5.8 per cent in December 2018, while the government set the inflation target at 5.6 per cent for FY 19.

The BB's latest estimation came against the backdrop of an upward trend of inflation in FY 18, following higher prices of food grains.

Meanwhile, the inflation as measured by consumers' price index (CPI) rose to 5.78 per cent in FY 18 on annual average basis from 5.44 per cent a year before, according to the Bangladesh Bureau of Statistics (BBS) data.

Food inflation stood at 7.13 per cent in FY 18 as compared to 6.02 per cent in the previous fiscal.

The central bank has decided to keep policy rates unchanged at their current levels, with repo and reverse repo rates at 6.0 per cent and 4.75 per cent respectively, due to elevated inflation expectation, exchange rate pressures, and rising global interest rates.

The BB also kept unchanged its private sector credit growth target to 16.8 per cent for FY 19.

On the other hand, credit growth to public sector is estimated at 8.6 per cent for H1 of this fiscal and 8.5 per cent for H2.

The public sector credit growth was negative 2.5 per cent in FY 18.

Meanwhile, private sector credit growth exceeded the target, set by the central bank earlier, in June despite a declining trend in the recent months.

The growth in credit flow to private sector came down to 16.95 per cent in June 2018 on a year-on-year basis from 17.60 per cent a month ago. It was 15.66 per cent in June 2017, the BB data showed.

The central bank in its last monetary policy set a target for the private sector credit growth at 16.80 per cent at the end of June 2018.

"The BB's continued focus on banks' adherence to asset-liability management (ALM) and foreign risk management guidelines along with the intensive and intrusive surveillance of credit quality is expected to support both financial and external stability in FY 19," the MPS noted.

To ensure quality of credit, the central bank chief emphasised further intensified monitoring and supervision from other government agencies concerned like the National Board of Revenue (NBR) and the Ministry of Commerce.

"We've already strengthened our monitoring and supervision to ensure credit flow to the productive and employment generating areas," the BB governor noted.

When asked about the higher interest rates on lending by some banks, he ruled out the claims, urging people to contact the central bank with specific information regarding the issue.

"We'll look into the matter seriously," the BB governor noted.

The total deposit in the country's banking sector stood at Tk 10.5 trillion, and 47 per cent of the amount is term deposits, according to Mr Fazle Kabir.

He also mentioned that the interest rates on deposits, particularly on the term deposit ones, will not be reduced until their maturity.

Currently, the banks, mainly the private commercial banks, are implementing the proposed cut in their lending and deposit rates in line with the decisions of the Bangladesh Association of Banks (BAB).

On June 20, BAB decided to bring down the interest rates on lending and deposit to 9.0 per cent and 6.0 per cent respectively from July 01.

The central bank highlighted the importance of bringing required reforms in the banking sector as far as sustainability is concerned.

The reforms include slashing the interest rate spread through reducing operational costs along with burden on classified loans, rationalising yield on savings instruments and treasury bonds, and creating environment to keep inflation at a low level.

"Changing interest rates on both lending and deposits in the money market will face obstacles unless the reforms are implemented immediately," the governor warned.

The MPS also said: "To make the banking channel more efficient, reducing corporate leverage, concentration risks, and NPLs remain important pre-requisites, which need to be accompanied by a timely and efficient debt resolution mechanism."

The central bank projected export growth at around 8.0 per cent, remittance growth at around 16 per cent, and import growth at 12.0 per cent for FY 19, resulting in a current account deficit of around 3.0 per cent of GDP.

When asked about the challenges for curbing inflationary pressures on the economy ahead of the upcoming general election, BB Chief Economist Faisal Ahmed said imports, particularly of food grains, may decrease in the coming months due to bumper production of rice.

"The trend of importing capital machinery might also fall, as the major portion of the industrial equipments for the mega projects has already been imported," he added.

Among others, BB advisers Allah Malik Kazemi and S K Sur Chowdury along with deputy governors Abu Hena Mohammad Razee Hassan, S M Moniruzzaman and Ahmed Jamal also spoke on the occasion.