The Lehman shock that erupted back in 2008 had mutated into global financial crisis. In response to the crisis, the US Federal Reserve (Fed) had embarked on an unprecedented non-standard monetary policy. Likewise, the European Central Bank (ECB) adopted a series of unconventional monetary policy (UMP) actions ranging from changes in the operational framework to large asset purchase programmes. ECB's first wave of measures took the form of slashing interest rate against the backdrop of 3-month Euribor/Overnight index spread reaching as high as 198 basis points on October 15, 2008 and starting and intensifying liquidity facility. Identifying that liquidity facility could hardly pacify the market, ECB resorted to an extreme asset purchase programme and continued that programme until 2012. Although there had been signs of gradual economic recovery after the crisis, Eurozone felt excessive deflation for a prolonged period. This disquieting signal prompted ECB to resume asset purchase programme in October 2014 to accelerate inflation close to 2.0 per cent in the medium run. Although the policy actions are justifiable on the ground of developments happening in Eurozone, they are likely to have repercussions on EU countries outside the euro area through both real and financial linkages.

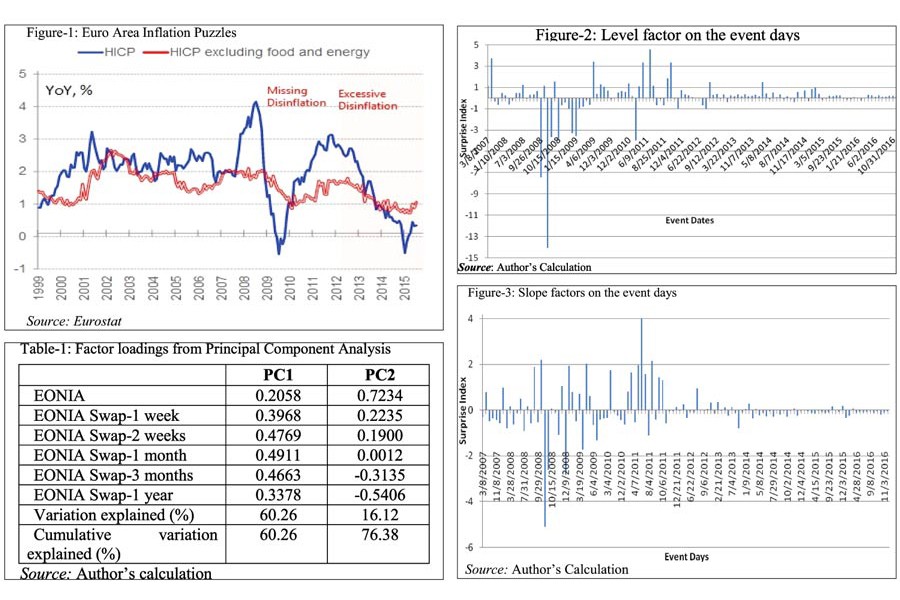

REVISITING EURO INFLATION AND GROWTH SCENARIO: Since the onset of the global financial crisis, euro area has experienced the emergence of twin puzzles: first missing disinflation during 2009 to 2011 and excessive disinflation after 2012 (Figure-1). The first puzzle was attributable to increased anchoring of inflation expectation resulting from ECB's credible monetary policy and increased weakening of the relationship between economic slack and inflation. Consequently, even during the economic recession euro area inflation remained moderately high. On the contrary, when euro zone economies was showing signs of recovery from economic fragilities since 2012, euro area inflation remained subdued for a prolonged period because of weakening relationship between economic slack and inflation. This development largely necessitated ECB to resume asset purchase programme.

ECB'S UNCONVENTIONAL MONETARY POLICIES AND BALANCE SHEET EXPANSION: The unconventional monetary policy era can be divided into two distinct phases (2008-12 and 2014-current) with each phase having separate objectives. The ECB's first phase's objective was to protect the EU economy from repercussions of US sub-prime crisis while second phase's objective was to fight deflation to achieve 2 per cent inflation. Note that in order for UMP to be effective, ECB slashed interest rate on main refinancing operations rate, deposit facility and marginal lending facility. ECB entered into negative territory of interest rate for deposit with ECB surpassing zero lower bound on June 11, 2014. Since the onset of financial crisis in 2007-08, the ECB has been stretching out its balance sheet to conduct monetary policy operation. At the end of 2016, the Eurosystem's balance sheet had reached all time high of Euro 3.7 trillion. The monetary policy measures, particularly asset purchase programme undertaken in June 2014, had largely contributed to the balance sheet expansion. While the monetary policy assets accounted for 61 per cent of total assets, the size of other components remained fairly stable at the end of 2016. Moreover, the asset purchase programme composition shows that public sector purchase programme accounts for 82 per cent of total purchase.

PASS-THROUGH OF ECB'S MEASURES: The benchmark financial asset has seen pronounced impact of ECB's easing policies adopted since 2014. The easing policies coupled with low interest rate environment have brought about marked decline in overnight index swap (representative of money market rate) and sovereign bond yield. Moreover, as a result of declining cost of borrowing for non-financial corporations and households, annual growth rate of loans to household and NFCs increased from -0.1 to 2 per cent and -2.9 to 2.3 per cent respectively between May 2014 and December 2016.

METHODOLOGY: Monetary policy decision comprises of two components: one is the decision itself and another is follow up communication clarifying the decision. It is the unanticipated component of monetary policy known as surprise factor that potentially captures the effect of monetary policy on asset prices. Although there is a wide pool of ECB's interest rate to choose from, this article uses EONIA, EONIA Swap rate of different maturities notably 1 week, 2 week, 1 month, 3 month and 1 year to measure surprise factors. It is reckoned that unexpected component of monetary policy decision drives the very short term rates (EONIA in euro zone) on the meeting day while EONIA swap rates for different maturities reflect the market expectation of ECB's key interest rate path over a longer horizon. The array of six series supposedly provides the pure monetary policy surprise. The daily changes of all interest rate series on the days when ECB announced its key UMP decisions are calculated collecting data from Bloomberg.

The principal component analysis (PCA) is used to let the data determine the monetary policy surprise factors. One can extract the pattern of daily movements of the rates using PCA. PCA reduces the dimensionality of a large number of possibly correlated variables and transforms the same into a smaller number of uncorrelated variables known as principal components. The input data matrix in this case corresponds to a 119X6 matrix where rows signify the 119 events and columns imply daily changes in six interest rate variables on the event days. Note that daily changes of all variables have been normalised to ensure that large variability in a series does not influence the analysis. PCA transforms this input data matrix into a set of six factors/components having length of 119 that corresponds to the event days. The first PC, going by other names such as first surprise factor or level factor, is related to the surprise of monetary policy decision itself and determines the changes in the level of the money market yield curve associated with ECB's announcement. On the other hand, the second PC known as slope factor is related to the market expectation of ECB's future policy stance and explains the changes in the slope of money market yield curve resulting from the ECB's announcement.

SURPRISE FACTORS: The factor loadings and explained variations associated with first two PCs are enumerated in Table-1. The result confirms that the unexpected component of monetary policy is likely to cause the co-movement of the rates as evidenced on the sign of their respective weights. The loadings show the extent to which each factor explains the rate. It is evident that level factor explains on an average 40 per cent of the rates' movement thereby causing the parallel shift of the money market yield curve. On the contrary, the second factor loadings show that short term rates with large weight causing a change in the slope of the money market yield curve. Hence the second factor can be viewed as the slope factor. It is seen that level factor explains about 60 per cent of the rates' variation while slope factor does about 16 per cent on the event days. The graphical representations of the level factor (figure-2) and slope factor (figure-3) reveal that ECB's monetary policy had surprise components in the first phase (2008-2012) but there have been less surprise components in the second phase suggesting that ECB could effectively communicate their policies with the market in the second phase.

Saidul Islam is Deputy Director, Bangladesh Bank. [email protected]

The views, thoughts and opinions presented here are based on the author's own analysis and do not necessarily reflect those of his employer (Bangladesh Bank), other organisations or any individual or group.